Guest contribution from Mohamed Ismail, friend of Smile Marketing and founder of Shift Accounting Inc.

To successfully grow your dental practice, it’s important to understand the health of your business. This is best done by having an efficient accounting system with the right functionality. Cloud based systems give you real time information that reveals how you’re performing at any given moment – so you don’t have to wait until the end of each month.

To successfully grow your dental practice, it’s important to understand the health of your business. This is best done by having an efficient accounting system with the right functionality. Cloud based systems give you real time information that reveals how you’re performing at any given moment – so you don’t have to wait until the end of each month.

If you haven’t switched over to a cloud based system, or if you don’t have a bookkeeper who highlights the key metrics you should focus on, no need to panic. Below you’ll learn what to look for when reviewing your financial reports.

Having worked with several high growth dental practices, I’ve identified 3 critical metrics that should be monitored closely on a monthly basis.

1. Productivity

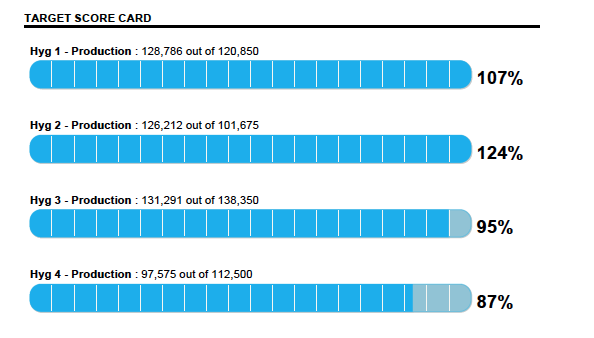

Monitoring production per provider is one of the most efficient ways to track how you’re performing operationally. To determine the current production trends you should benchmark each provider's monthly production against budget and year-to-date numbers. The right system allows monthly management reports, which include benchmarking to help keep them on track.

This analysis keeps you aligned to your budget and gives you the insight to correct underlying production issues. For example, during your monthly review, you recognize that the production of Hygienist #4 has been declining over the past 3 months. You are concerned that she will not meet her annual target. You dig into this issue with your office manager who determines that the cause of this reduction is scheduling.

Early recognition of operational issues such as this can save you a lot of time and money, and will ultimately improve your bottom line.

2. Cash

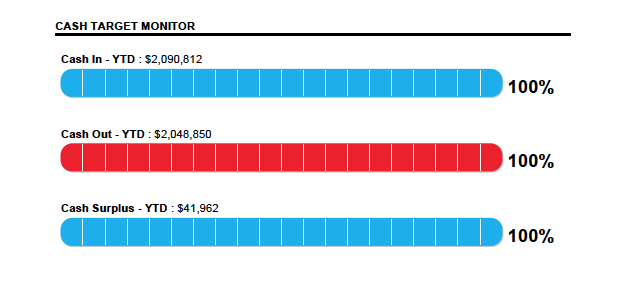

It’s no secret that cash flow is vital to the survival of any business. If there are any red flags or concerns around your cash flow, they should never be taken lightly, even if your practice is profitable.

One of the most common mistakes made by practice owners and inexperienced bookkeepers is not understanding the difference between cash and profit. Your monthly profit is not equal to the amount of cash you have available.

Your profit is calculated as the difference between your revenue and expenses (both found on your profit and loss statement). Cash flow, on the other hand, takes into consideration items such as personal loan payments (found on your balance sheet). Not understanding the difference may lead you to spend money that you do not have.

Your monthly cash flow review with your bookkeeper should always include a conversation about topics including: if you have enough cash to meet current obligations, how your collection time is impacting cash flow and what your options are if you have cash in excess of your obligations. The strategy for excess cash will differ depending on your goals and objectives.

3. Profitability

Profitability is the ability of a practice to generate more revenue than the expenses it incurs. In other words, it’s when your practice has more money coming in from dental billings and hygiene fees than money going out from expenses (including wages, supplies and rent). Your goal is to see your profitability grow each month, and your bookkeepers’ goal should be to use your financial reports to figure out how.

Reviewing net income as a percentage of production is a great way to quickly see how efficient your practice is in generating profit. A higher percentage indicates a more profitable practice with better control over its costs.

For example:

As you can see net income as percentage of net production is a powerful metric for understanding profitability. It can quickly tell you which direction your practice is heading. If this is not already a part of your monthly review, ask your bookkeeper to include it going forward.

In closing, here are a couple of things you should keep in mind:

- The analysis of these metrics is only useful if your financial reports are compiled accurately. Always ensure your books are in good hands by using an accountant/bookkeeper who has experience with dental practices.

- Ask your accountant/bookkeeper to review your production, cash flow and profitability with you on a monthly basis. Reviewing these metrics with an experienced professional will help you reach your financial goals.

Would you like a free analysis of your current financial reports? Send them over and we will tell you what areas to focus on for improvement. Send files to me directly at mohamed@shiftacct.com. If you would like to learn more visit our blog to discover resources for new dental offices.